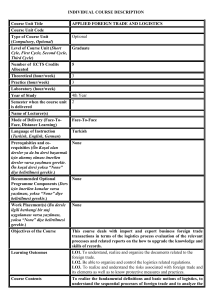

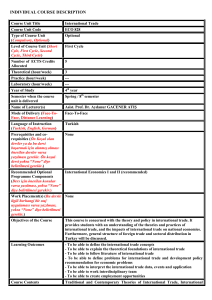

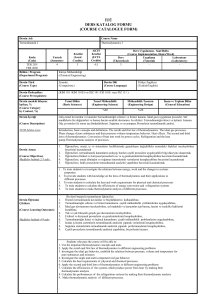

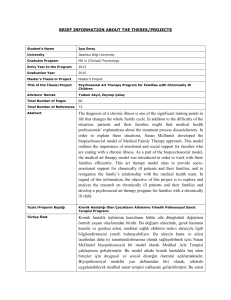

INDIVIDUAL COURSE DESCRIPTION

Course Unit Title

FOREIGN TRADE AND ACCOUNTING

Course Unit Code

Type of Course Unit

(Compulsory, Optional)

Optional

Level of Course Unit (Short

Cyle, First Cycle, Second Cycle,

Third Cycle)

First Cycle

Number of ECTS Credits

Allocated

5

Theoretical (hour/week)

3

Practice (hour/week)

3

Laboratory (hour/week)

Year of Study

3rd Year

Semester when the course unit

is delivered

3rd Year 1st Semester

Name of Lecturer(s)

Mode of Delivery (Face-ToFace, Distance Learning)

Face-To-Face

Language of Instruction

(Turkish, English, German)

Turkish

Prerequisities and corequisities (Ön Koşul olan

dersler ya da bu dersi başarmak

için alınmış olması önerilen

dersler varsa yazılması gerekir.

Ön koşul dersi yoksa “None”

diye belirtilmesi gerekir.)

None

Recommended Optional

None

Programme Components (Ders

için önerilen konular varsa

yazılması, yoksa “None” diye

belirtilmesi gerekir.)

Work Placement(s) (Bu dersle

ilgili herhangi bir staj

uygulaması varsa yazılması,

yoksa “None” diye belirtilmesi

gerekir.)

None

Objectives of the Course

The purpose of this course is to explain the import and export business

foreign trade transactions and the accounting processes as well as, to

improve the knowledge and skills of records related to relevant ledger

accounts and related reports.

Learning Outcomes

LO1. To Learn Foreign Trade Accounts Used In Foreign Trade Operations.

LO2. To Learn About The Accounting Treatment Of Foreign Exchange

And Related Financial Instruments

LO3. To Be Able To prepare financial reports about Foreign Trade

Transactions

Course Contents

Includes the definition and basic concepts of accounting, balance sheet,

income statement, foreign trade, accounting for foreign currency

transactions, the accounting for foreign currency transactions. Also it

includes forward transactions and taxation, swap transactions and

taxation.

Weekly Detailed Course

Contents (yarıyıllık dersler için

arasınav ve final sınavları dahil

edilerek 16 haftalık, yıllık

dersler için arasınav ve final

sınavları dahil edilerek 30

haftalık)

1 Week Importance of Foreign Trade Accounting

2 Week Foreign Trade Regime, Customs Act and the Foreign Exchange

Regulations

3 Week Delivery of Foreign Trade (Sales) Forms, Payment Methods,

Documents

4 Week Accounts in Foreign Trade

5 Week Foreign Currency and Foreign Currency Concepts

6 Week Accounting for Foreign Currency Transactions in Cash

7 Week Accounting for Foreign Currency Transactions in Accounts

Receivable

8 Week Midterm

9 Week Recognition of Overseas Production and Inventory Accounts

10 Week Accounting for Value Added Tax on Foreign Transactions

11 Week Accounting for Foreign Currency Long-Term Assets

12 Week Dealers in Foreign Exchange Operations and Accounts Payables

13 Week Financial Instruments: Recognition and Measurement (Forward,

Swap)

14 Week Cost Accounts in Foreign Transactions and Income Statement.

15 Week Foreign Transactions in the Balance Sheet Arrangement

16 Week Final

Recommended or Required

Reading

• Yaser Gürsoy, Dış Ticaret İşlemleri Muhasebesi, Ekim Basın Yayın,

Bursa, 2012

• Ferudun Kaya, Dış Ticaret İşlemleri Muhasebesi, Beta Basım Yayım,

2011

ASSESSMENT

Term (or Year) Learning

Activities

TOTAL

Weight, %

100

Contribution of Term (Year)

Learning Activities to Success

Grade

40

Contribution of Final Exam to

Success Grade

60

100

TOTAL

Planned Learning Activities, Teaching Methods, Evaluation Methods and Student Workload

Activities

Course hours

Quantity

Duration

(hour)

Total Work Load

(hour)

16

3

48

10

3

30

Lab

Application

Special Course Internship

Field Work

Study hours out of class

Presentations/ Seminar

Project

Homework Assignments

2

5

10

Mid-Terms

a)Exam

b) Student’s preparation

1

4

2

5

2

20

Final

a)Exam

b) Student’s preparation

1

5

2

8

2

40

TOTAL

39

28

152

ECTS Credits

152/28=5 ECTS

Contribution of Learning Outcomes to Programme Outcomes*

Learning

Outcomes

Programme Outcomes

PO1 PO2 PO3 PO4 PO5 PO6 PO7 PO8 PO9 PO10 PO11 PO12 PO13 PO14 PO15 PO16 PO17

LO 1

LO 2

LO 3

4

5

5

5

5

5

4

5

5

4

5

5

5

5

5

* Contribution Level: 1 Very Low

5

4

5

5

5

5

2 Low

4

5

5

5

4

5

3 Medium

4

5

5

5

4

5

4 High

5

4

5

5

5

5

5

5

5

5 Very High

5

5

5

4

4

4

4

4

4